Pacific Capital Bancorp Refutes Takeover Gossip

Rumors of Santa Barbara Bank & Trust's Demise Greatly Exaggerated, Officials Say

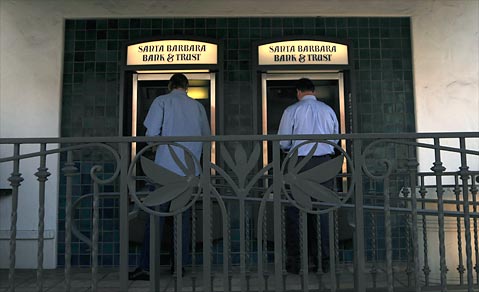

Pacific Capital Bancorp (PCB) officials vigorously denied this afternoon a loud rumor that the bank is due to be shut down by the federal government. PCB is the parent company of Santa Barbara Bank & Trust, and the two organizations share corporate offices on Anacapa Street in Santa Barbara.

“That’s preposterous,” said PCB President George Leis in response to the rumor, which has been circulating all week.

“Absolutely crazy,” said Fred Clough, the bank’s general counsel.

Debbie Whiteley, the bank’s public relations officer, added that the feds “don’t take over strongly capitalized banks.”

The news, announced earlier this week, that PCB is suspending dividend payments on the federal bailout funds it received via the Troubled Asset Relief Program, as well as dividend and interest payments on other preferred and common stock, is presumed to have given rise to the rumor. As 4 p.m. Friday approached – the hour when federal officials traditionally arrive, unannounced, to shut down banks if they are going to do so – the three officials met with this reporter at the banks’ headquarters.

The reason his bank is suspending dividends, Leis explained, is in order to “fortress the balance sheet” against potential vicissitudes, given the uncertain economic climate. “It’s to bolster the capital ratios, which exceed the criteria for a bank being well capitalized,” said Clough. The bank’s tier one capital ratios at the end of the first quarter were “very strong compared to those of our peers,” Whiteley added.

“We are a safe and sound bank,” Leis emphasized. “We’re well capitalized and have plenty of liquidity. We’re taking prudent steps to build capital because we’re in the middle of a tough economy – the worst recession that this company, certainly, has had to weather. The larger our surplus account, the better our ability to weather a storm.”

Clough said PCB has the same agreement with the Department of Treasury as all other banks who received bailout funds. The Treasury now owns $180.6-million worth of PCB preferred shares. Clough said the agreement allows deferred dividend payment. “We are not violating any agreement,” said Clough. “We have a great relationship with the regulators,” said Leis, specifically the Glendale office of the Office of the Comptroller of the Currency, “and talk to them regularly. They have asked us to continue accruing capital.”

The bank officials said they wanted to remind the public that interest-bearing accounts are all insured by the Federal Deposit Insurance Corporation for up to $250,000 – and that the bank’s non-interest-bearing checking accounts are insured 100 percent regardless of the amount in them. (David Barr, a spokesman for the FDIC, said most banks opt-in to the unlimited deposit insurance program for checking accounts–typically payroll accounts–that pay 0.5 percent interest or less. Most checking accounts pay more interest, but don’t contain more than $250,000.)

What ordinarily happens when banks are taken over is that the federal government first sells the bank to another bank, goes in and closes it on Friday afternoon, and reopens it Monday morning under new management.

There was no run on the State Street branch of Santa Barbara Bank & Trust on Friday afternoon, according to one bank customer who did go in near 4 p.m. to withdraw the funds from his account in response to the rumors. He said bank employees were joking nervously among themselves, however, about the possibility of the shutdown, which never came.