Proposed Bill Could Repeal Large Tax Expenditures

Senator Jackson Introduces SB 468

In just over 10 years, from 2008 to 2020-21, $506.4 billion will have been lost from the General Fund because of tax credit and exemptions, the state Department of Finance estimated. In comparison, the 2019-20 General Fund budget approved by Governor Gavin Newsom was $144.2 billion. The $506.4 billion loss is a result of these nearly 80 corporate tax expenditures in California. Few of the expenditures have language describing their intended policy goals, and even fewer have been evaluated to determine whether their goals are being met.

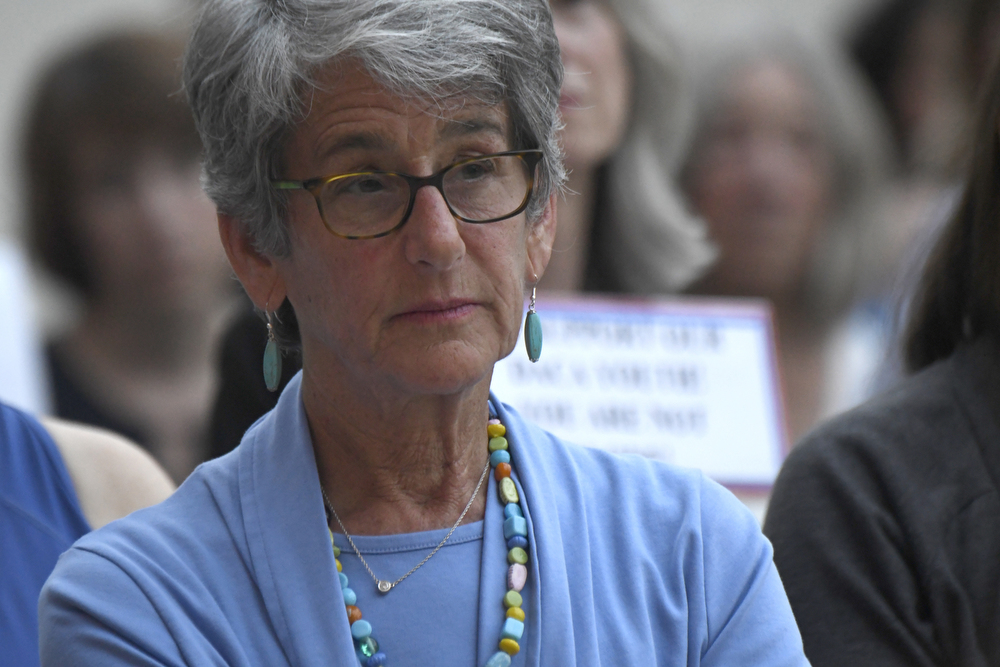

Senator Hannah-Beth Jackson teamed up with educators to unveil Senate Bill 468 on April 16, which proposes an evaluation of the nine most expensive tax expenditures that have no sunset and no data. “For too long, California has routinely granted generous tax credits. Without asking whether they deliver economic or social benefits to our state,” said Jackson.

Tax expenditures have also been negatively affecting school funding. Proposition 98 appropriates a minimum percentage of the general fund to education funding. As the general fund has lost out on billions, so too have schools. It is estimated that schools have lost out on 40 cents of every dollar, amounting to approximately $26.6 billion less a year, said Jennifer Baker, with the California Teachers Association. That’s in addition to the $65 billion cut from schools to balance the budget, said Baker.

While California has the strongest economy in the country, its education funding per pupil is found among the bottom 10 states. If all nine of the tax expenditures in SB 468 are found to be ineffective in their policy goals and are subsequently repealed, that could lead to almost $3 billion in additional funding a year for public schools, said Dennis Meyers, of the California School Boards Association.