The Music Stopped Playing in 2012

But Commercial Landlords, Homeowners, and City Council Are Still Dancing

Another week and another set of articles about how to “fix downtown” and how to “fix high housing costs.”

Downtown Santa Barbara has lost its appeal because the rent is too high for high-quality local shops and restaurants to survive!

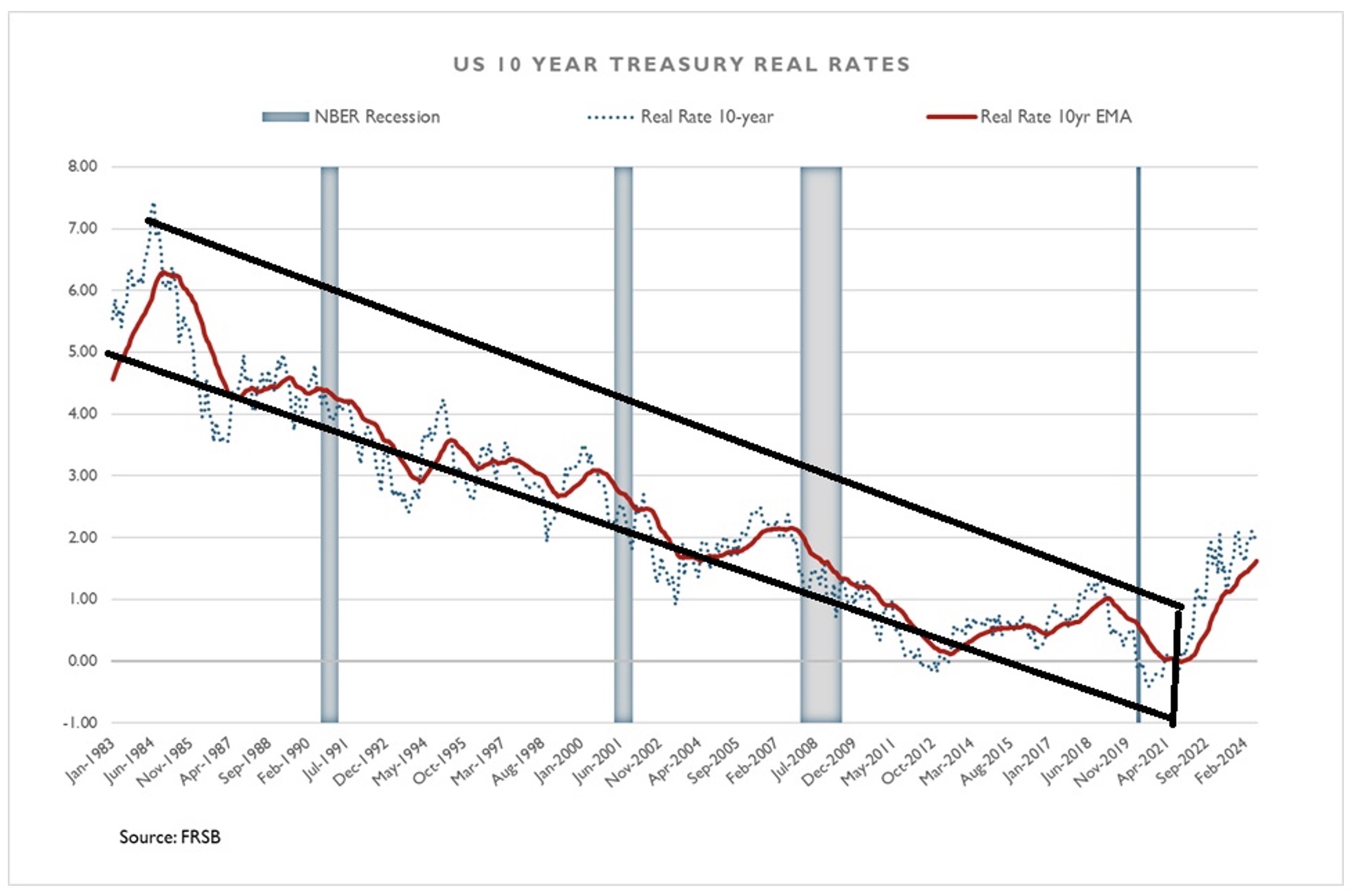

I am all too familiar with the need for more knowledge and understanding of financial theory among homeowners, business owners, and commercial landlords who became rich by riding the wave of falling real rates.

A situation has existed since 2012 when real interest rates bottomed out in negative territory. The music stopped playing in 2012, but homeowners, business owners, commercial landlords, and city councils are still dancing.

Stocks and real estate are forward-looking assets priced according to global investors’ willingness to hold the asset, grounded in their estimates of discounted future cash flows. How far into the future investors are peering at any given time depends on the current socioeconomic environment and market psychology.

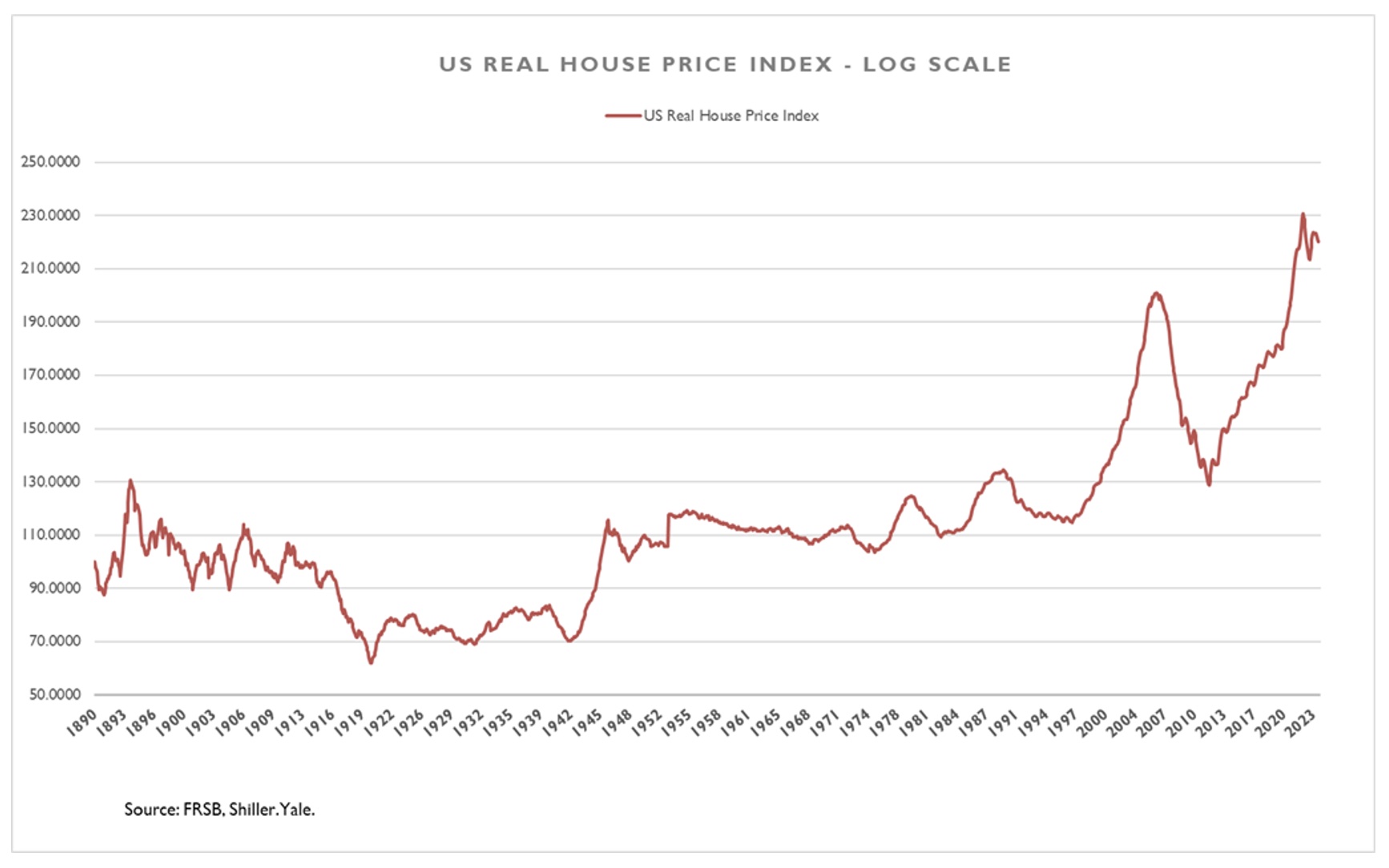

I hear all too often that stocks and real estate prices will always rise cyclically. This is simply not historically true or good logic.

I also hear that Santa Barbara property values will always rise because it’s a unique and desirable place to live. Again, this is not historically accurate or sound logic.

Yes, Santa Barbara housing prices will probably always be relatively high, but that doesn’t mean they are disconnected from global markets. Santa Barbara real estate prices will generally track the rise and fall of global risk asset markets, rising and falling at similar rates as the rest of the U.S. and the world, though starting from a higher level.

Even if the City Council implemented an award-winning plan for designing pavements, planter boxes, and managing traffic, it wouldn’t solve the core issue: commercial landlords who do not understand basic financial theory or have painted themselves into a corner by borrowing too heavily based on rental yield projections that stopped being realistic in 2012, and as a result, they refuse to lower rents.

In my experience, commercial landlords and homeowners either don’t understand or refuse to face the fact that, after nearly 40 years of falling real interest rates, property values are based on unrealistic rent expectations.

The mayor and City Council may or may not be aware of the finer points of financial theory, but like all local politicians in the United States, they are at the mercy of a dysfunctional capital allocation system that has not evolved since we were a sparsely populated agrarian nation.

Politicians should follow the recommendations of domain experts and should not make decisions based on political ideology, but that’s precisely what Congress does, even though decisions are often wrapped in economic terms.

Here, we face another dilemma: Economics is not a natural science. It’s political philosophy without natural laws, and economists often don’t understand that the most relevant demand in real estate is the demand for rental yield, not shelter. It’s a philosophy that special interest groups use to mold public opinion. The public must learn that economics is not a functional science and that many of its claims cannot be replicated or proven by established scientific methods.

As Chinese politicians are discovering, one cannot build an economy on cyclically rising real estate values. Beyond its agglomeration value, real estate doesn’t add to aggregate productivity. (Agglomeration economies are the benefits from firms and people being able to freely exchange ideas and capital.)

Anchoring economic activity on real estate is a mistake. A mistake amplified by agglomeration effects diffusing from physical communities to digital networks, where the physical location of firms and people is no longer a critical factor in creating these effects.

Real estate is overvalued in large parts of the developed world and in my opinion is headed for a series of deflationary cycles — cycles that could be helped along by significant private market property write-downs and lower rents.

Like the housing, health care, and education crises, the solution to dysfunctional downtowns is government funding for necessary goods and services. However, political propaganda in America is so pervasive that few are aware of why supply-side policies like “Reaganomics” became a political issue rather than an economic tool that should only be applied during times of full employment, not as a perpetual fix. In today’s America, saying this, one risks being labeled a “Socialist.”

As a result, I expect towns and cities across the U.S. to endure many years of painful property value adjustments. These adjustments will profoundly challenge the American system of local governments focused on pleasing landlords and business owners instead of creating functional communities that optimize the quality of life for all residents.

The American community development system is backward and maladaptive, relying on property and sales taxes to fund necessary municipal services — a system that functions as a mechanical segregation mechanism that produces inequality and division. America needs to enter the modern world and establish a tax-and-spend system based on income, sales, and value-added taxes, combined with direct federal funding for everything a functional community needs to thrive.

Until that day comes, say hello to the era of commercial landlords going bankrupt and municipal bond rating downgrades.

Kristian L.T. Blom is managing partner at Blom Levy & Co.

You must be logged in to post a comment.