When it comes to real estate, it seems like there is always a story. Barbie finds dream home in Super Bowl TV commercial! Buy Sunset and flip your way to millions! Home remodel for less than your grocery bill! Rates plummet! Rates skyrocket! Clickbait abounds, and seeing folks on another side of the country find the perfect, slightly beat-up to beautiful abode for less than the lowest closed condo in South County can make anyone feel like the deck is stacked against them.

That said, there’s plenty of opportunities to put yourself in the right position if you know a few key rules of thumb. From qualifications to budget, here’s a few that you can keep top of mind.

The Rule of 45 Percent: Qualifications vary per program, company, investor, and offering, yet most loans will qualify with a 45 percent debt-to-income ratio. This means that the total of your monthly obligations fall within 45 percent of your total gross income. So, if you bring in $10,000 per month, then the total of your housing payments and minimum monthly payments from your credit report are capped at $4,500.

Your housing payment is your mortgage + taxes + insurance + homeowners association dues (HOA). It is not your utilities or cell phone bill. Your minimum monthly payments from your credit report are things like car loans, student loan payments (yes, even if deferred, they’ve got be counted), minimum credit card payment (yes, even if you pay to zero, some sort of payment usually reports), and even things like alimony, child support, or co-signed debts can be included. It is not your wine club or Netflix subscriptions, or even your car insurance. Looking at these levels of payments in relation to your income tells you how much you can qualify for.

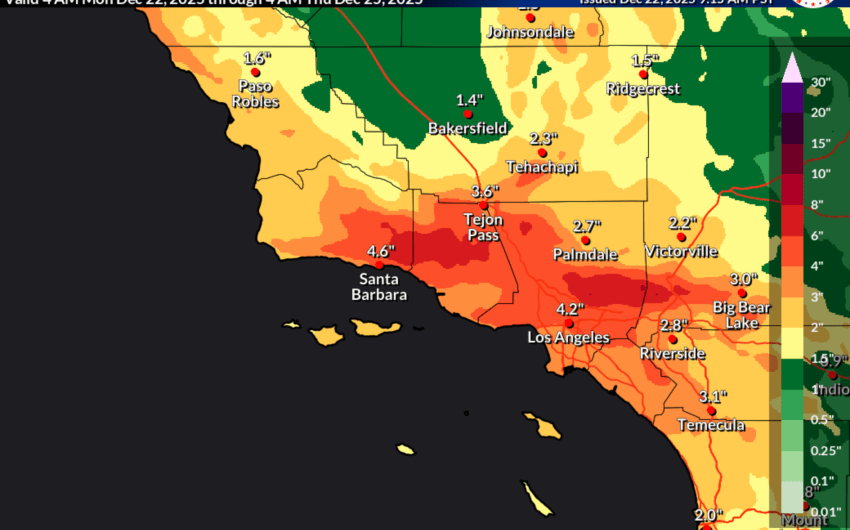

But in order to qualify, we have to know the housing payment level, right? A rule of thumb here is that every $100,000 in real estate costs around $700 per month. So, if you are buying a $500,000 condo, then it would cost around $3,500 per month. Or if you are buying a $1,000,000 house, then it would cost around $7,000 per month. Again, your terms can and probably will be different — insurance is quite variable these days if you are in a flood zone or high fire area — however, this will give you a general idea.

It is commonly known that down payments are usually broken into percentages: 5 percent, 10 percent, 20 percent, and so on. Yet even if you have a strict goal of $75,000, you can still use the Closing Cost Factor of 2 Percent. This gives you a buffer for the three buckets of closing costs that apply to every mortgage transaction: loan fees, title and escrow fees, and prepaid items. The first are relevant to your lender and loan structure. The second is relevant to the terms laid out in your purchase contract, or selected title and escrow company. The third refers to the recurring cost of homeownership that you prorate at closing; property taxes, insurance bills, or interest may all be due at the time of closing.

By combining these three rules into your personal situation, you can do some quick calculations, put yourself on the right path, and save yourself that next annoying pop-up ad.

Austin Lampson is a licensed mortgage professional and branch manager of Homeowners Financial Group. She has spent the last quarter-century helping her clients balance math and emotion to achieve their financial goals. Reach Austin at (805) 869-7100, alampson@homeownersfg.com, or visit austinlampson.com.

Premier Events

Wed, Dec 31

9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Fri, Dec 26

7:00 AM

Solvang

Solvang Julefest

Sat, Dec 27

7:00 PM

Santa Barbara

Schnack ‘n Bari Jazz Trio at Roy

Wed, Dec 31

6:15 PM

Santa Barbara

NYE 2026 with SB Comedy Hideaway!

Wed, Dec 31

9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Wed, Dec 31

10:00 PM

Santa Barbara

In Session Between Us: Vol. I NYE x Alcazar

Wed, Dec 31

10:00 PM

Santa Barbara

NYE: Disco Cowgirls & Midnight Cowboys

Thu, Jan 01

7:00 AM

Solvang

Solvang Julefest

Thu, Jan 01

11:00 AM

Santa Barbara

Santa Barbara Polar Dip 2026

Sat, Jan 03

8:00 PM

Santa Barbara

No Simple Highway- SOhO!

Sun, Jan 04

7:00 AM

Solvang

Solvang Julefest

Wed, Dec 31 9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Fri, Dec 26 7:00 AM

Solvang

Solvang Julefest

Sat, Dec 27 7:00 PM

Santa Barbara

Schnack ‘n Bari Jazz Trio at Roy

Wed, Dec 31 6:15 PM

Santa Barbara

NYE 2026 with SB Comedy Hideaway!

Wed, Dec 31 9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Wed, Dec 31 10:00 PM

Santa Barbara

In Session Between Us: Vol. I NYE x Alcazar

Wed, Dec 31 10:00 PM

Santa Barbara

NYE: Disco Cowgirls & Midnight Cowboys

Thu, Jan 01 7:00 AM

Solvang

Solvang Julefest

Thu, Jan 01 11:00 AM

Santa Barbara

Santa Barbara Polar Dip 2026

Sat, Jan 03 8:00 PM

Santa Barbara

No Simple Highway- SOhO!

Sun, Jan 04 7:00 AM

Solvang