Welcome to my first article! I have decades in the mortgage industry and am not afraid of social media, yet it is entirely different writing an article for my community.

Mortgage lending has gone through many iterations and changes in the past decade; however, some principles remain concrete.

Let’s start here: All mortgage loans are based on four building blocks: income, assets, property, credit. While one doesn’t necessarily override the other, these all go together like a game of Jenga. And while each type of loan has its own guidelines and requirements, these four aspects must be balanced for one to obtain a residential mortgage loan.

Let’s play!

Income is perhaps the most scrutinized category. Consistency of income and expected continuity of receipt are the main factors; this is the money that is coming in each month to pay the mortgage that is going out each month. For folks that work for a company, this can simply mean looking at your wages. If we work overtime, get bonuses, or earn commission, the variability needs to be addressed. If you work more than one job, you’ll likely need to show that you’ve done so for two years.

Self-employed applicants typically need two years of tax returns at a similar level of income. Thankfully, it is understood that self-employed individuals sometimes get tax write-offs that W-2 folks cannot. Alternative qualifications involve using business bank statements, personal bank statements, or perhaps even a profit and loss statement.

Then there’s passive income, partnerships, and pass-through. Income nuances are as varied as your life story. Keep in mind that the more creative things need to be, the higher the price tag could be for repayment.

When we are referencing assets, we’re primarily looking for liquidity. This means money that you can access relatively easily. When it comes to assets for loans, if it’s hard to track or access, it is probably hard to use for qualifying.

And just how much money does a lender look for? Well, different programs require verifications of the down payment, closing costs, as well as reserves. Think of “reserves” as cash you have on-hand after closing.

With big purple cows tap-dancing across screens advertising quick “pickups” in your credit score, one would think that those three digits are the most important factors of credit. Sorry, folks, but this is certainly not the case. There are actually three algorithms per credit bureau, and three credit bureaus. This means there are 21 possible scores out there, and each type of creditor typically uses a different variation than another. What you see on an app isn’t necessarily what your lender will use.

Credit and liabilities are not simply your credit score, but the depth of credit, frequency of payments, and sometimes even things that may not even show up on the actual report. Obligations such as childcare, child support, alimony, or IRS/tax liability payments may need to be taken into account.

For property, the main scrutiny will be on the property that is being financed. If you own more than this property, or have inherited property, be prepared for additional questions and verifications.

Jenga is indeed an apt reference. The regulated, nuanced, building blocks of a mortgage loan are played out by the decisions and circumstances of your life. How we put them together equates to your loan.

My goal is to help folks understand and be able to utilize the nuances of lending in their life. Housing stability and wealth through real estate are passions of mine. Thanks for reading, and see you next month!

Austin Lampson is a licensed mortgage professional and branch manager of Homeowners Financial Group. She has spent the last quarter-century helping her clients balance math and emotion to achieve their financial goals. Reach Austin at (805) 869-7100, alampson@homeownersfg.com, or visit austinlampson.com.

Premier Events

Wed, Dec 31

9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Sat, Dec 27

7:00 PM

Santa Barbara

Schnack ‘n Bari Jazz Trio at Roy

Wed, Dec 31

6:15 PM

Santa Barbara

NYE 2026 with SB Comedy Hideaway!

Wed, Dec 31

9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Wed, Dec 31

10:00 PM

Santa Barbara

In Session Between Us: Vol. I NYE x Alcazar

Wed, Dec 31

10:00 PM

Santa Barbara

NYE: Disco Cowgirls & Midnight Cowboys

Thu, Jan 01

7:00 AM

Solvang

Solvang Julefest

Thu, Jan 01

11:00 AM

Santa Barbara

Santa Barbara Polar Dip 2026

Sat, Jan 03

8:00 PM

Santa Barbara

No Simple Highway- SOhO!

Sun, Jan 04

7:00 AM

Solvang

Solvang Julefest

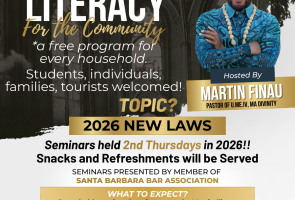

Thu, Jan 08

6:00 PM

Isla Vista

Legal Literacy for the Community

Wed, Dec 31 9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Sat, Dec 27 7:00 PM

Santa Barbara

Schnack ‘n Bari Jazz Trio at Roy

Wed, Dec 31 6:15 PM

Santa Barbara

NYE 2026 with SB Comedy Hideaway!

Wed, Dec 31 9:00 PM

Santa barbara

NEW YEAR’S Wildcat Lounge

Wed, Dec 31 10:00 PM

Santa Barbara

In Session Between Us: Vol. I NYE x Alcazar

Wed, Dec 31 10:00 PM

Santa Barbara

NYE: Disco Cowgirls & Midnight Cowboys

Thu, Jan 01 7:00 AM

Solvang

Solvang Julefest

Thu, Jan 01 11:00 AM

Santa Barbara

Santa Barbara Polar Dip 2026

Sat, Jan 03 8:00 PM

Santa Barbara

No Simple Highway- SOhO!

Sun, Jan 04 7:00 AM

Solvang

Solvang Julefest

Thu, Jan 08 6:00 PM

Isla Vista