With the City of Santa Barbara facing a projected $7.1 million budget deficit, policymakers are looking to help ease the pressure by finding new ways to bring in more money to make up for the fact that the city’s costs are growing much faster than its revenues.

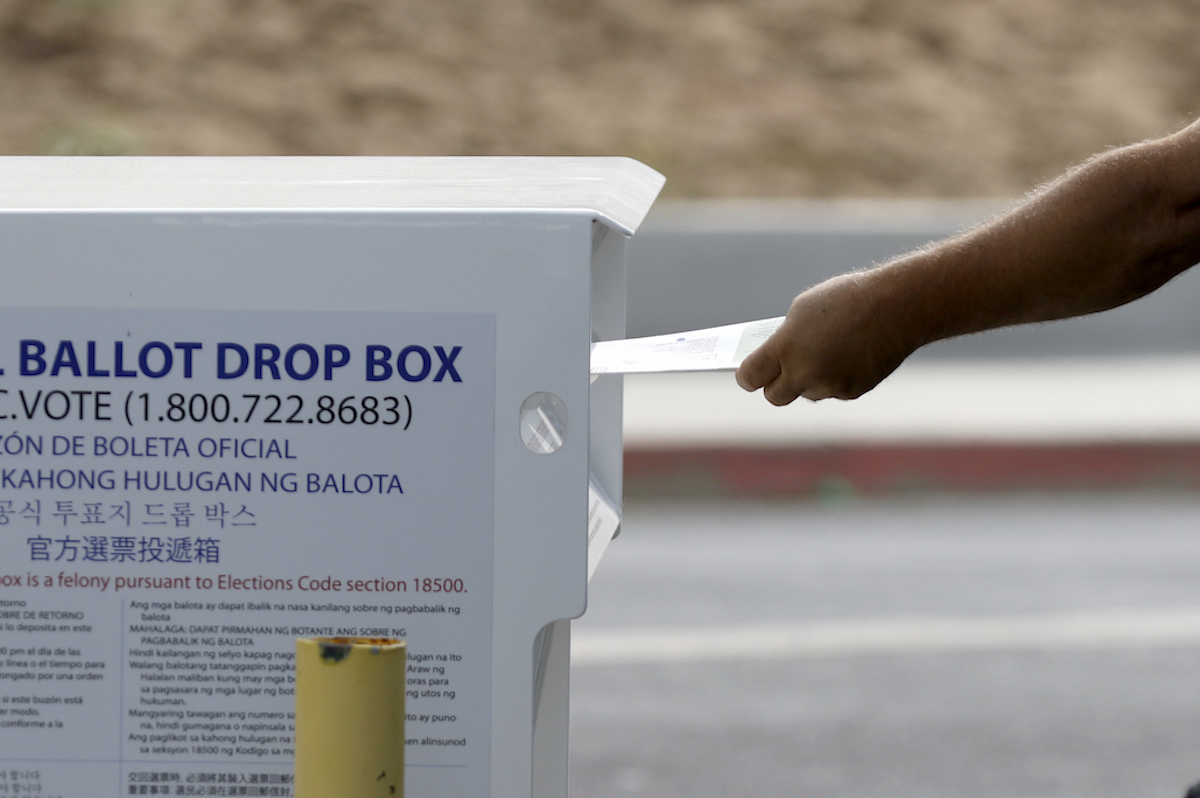

On Tuesday, the city’s Finance Committee will be considering a proposal for a ballot measure that would let the voters decide whether to adopt a half-cent sales-tax increase — from 8.75 percent to 9.25 percent — that could bring in an estimated $15.6 million a year toward public services and city maintenance.

According to the staff report prepared by Finance Director Keith DeMartini, balancing the city’s annual operating and capital budget has become “increasingly challenging given the slow growth of tax revenues and substantial increases in staff, services, contracts, insurance, and many other expenses.”

DeMartini’s report says that many other California cities are also dealing with increased costs of maintaining services that exceed projected revenues, and that Santa Barbara’s structural deficit is only expected to get larger over the next few years.

Part of the pressure is a holdover from COVID. In 2020, the city experienced a “rapid and substantial decline” both in sales-tax and transient-occupancy-tax revenues, DeMartini said, resulting in a $30 million reduction in revenue across all funds. The general fund, which covers essential services such as public safety, took the biggest hit, according to the report, with an impact of more than $20 million.

This meant that the city had to make some tough decisions to reduce costs by “nearly eliminating all hourly employees, delaying projects, and reducing services,” leaving many departments unable to fill vacant positions.

City staff hosted more than 20 meetings to discuss interest in the ballot initiative, including six community town halls from late April to early May. Outreach included bilingual press releases and radio announcements, city news updates, social media posts, citywide mailers, and emails sent out to all city subscribers.

The city also conducted a community poll to gauge whether residents would be interested in a general-purpose transaction-and-use-tax increase that would require at least 50 percent voter approval in the November 2024 election. The results of the poll will be presented during the Finance Committee’s meeting on Tuesday, May 14.

When the County of Santa Barbara released the results of a similar survey a month ago, voters were split 50/50 on the idea of a one percent sales-tax increase.

The Finance Committee will discuss the ballot measure and consider forwarding the item to the City Council for full deliberation and adoption. If approved, the initiative will go on the November ballot, and with at least 50 percent voter approval, the new sales tax rate of 9.25 percent would go into effect on April 1, 2025. If implemented, this increase could bring an estimated $3.9 million in the first half-year and up to $15.9 million per year after that.

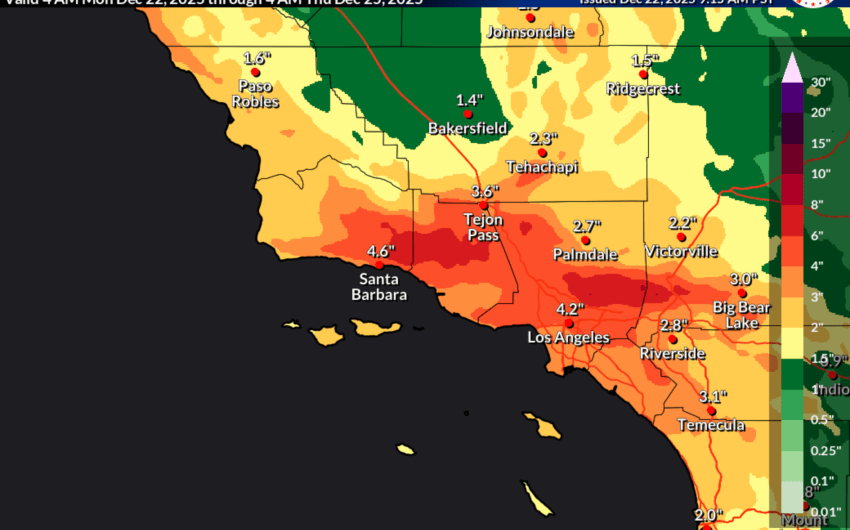

Funds from the tax increase could be used for responding to emergencies; keeping neighborhood fire stations open; improving housing affordability; addressing homelessness; keeping public areas clean; maintaining library services; improving natural disaster preparedness and stormwater protection measures; and retaining local jobs, as well as for general government use.