It’s no secret that millennials are buying homes at much lower rates than previous generations, especially in Santa Barbara, where housing prices have forced many born between 1981 and 1996 to remain as renters through much of their early adulthood. And according to a new study, Gen Z, the latest wave of young adults, will likely see the same struggles as their predecessors, spending nearly 30 percent of their incomes on rent by the age of 30.

The study was conducted by RentCafe, a nationwide apartment search website, which compared the incomes and housing costs for the two generations across 197 major cities as they navigated the ages of 22 through 29, with costs for each group adjusted to 2023 U.S. dollars.

According to the data, millennials in Santa Barbara spend an average of $184,000 on rent by the age of 30, accounting for 26 percent of their total income. Millennials who owned homes, on the other hand, spent more than $275,000 on housing in the same time span, a figure that equals about 40 percent of their expected income of $700,000.

The study also discovered that although Gen Zers are racking in more income in their twenties on average compared to millennials in Santa Barbara (totaling $711,000 versus $700,000), they stand to spend at least $209,000 as renters, or about 29 percent of their income by the age of 30. Gen Z homeowners are expected to spend up to $274,000, or about 38.5 percent of their expected income.

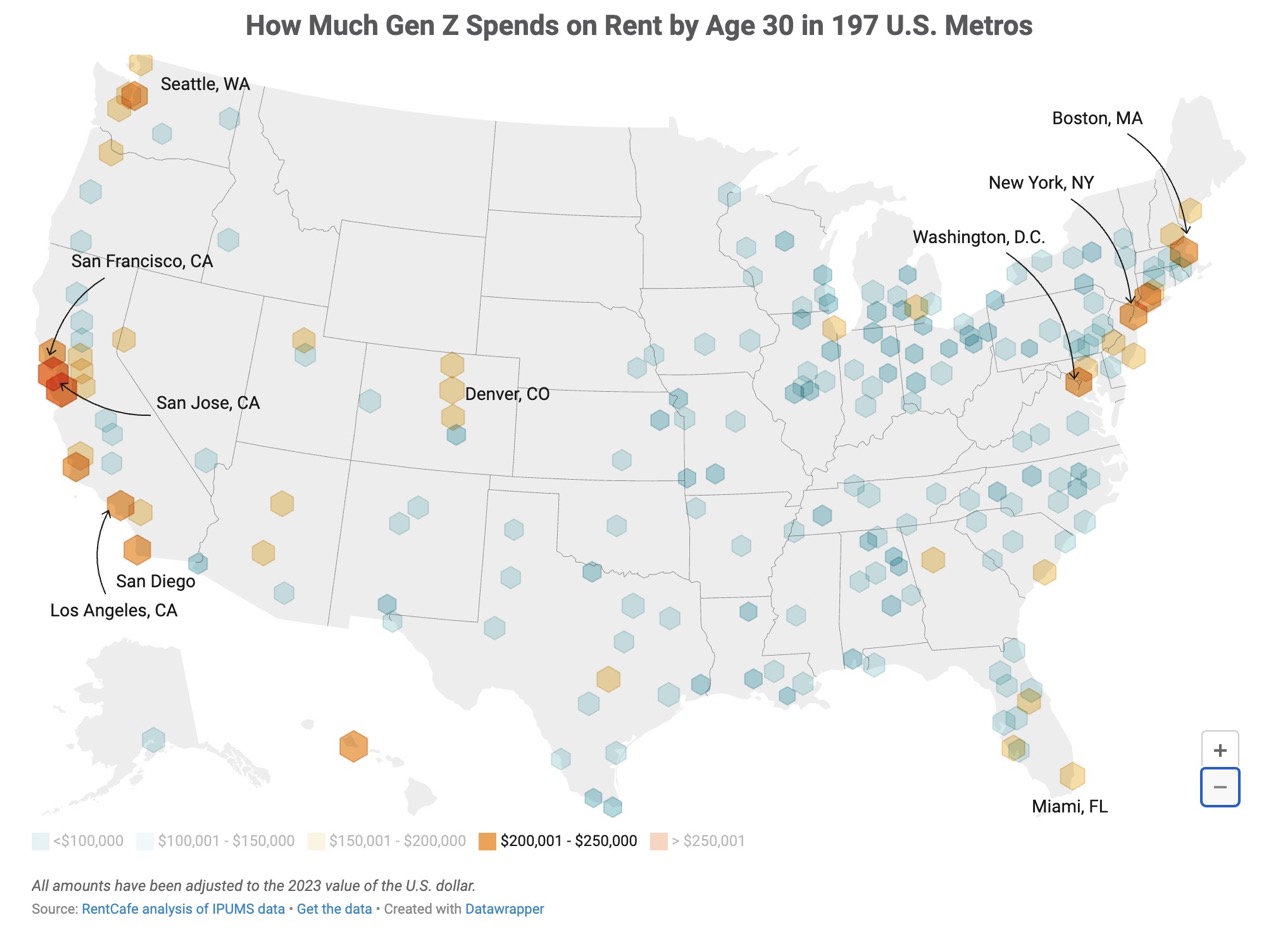

According to RentCafe, renting for Gen Z in Santa Barbara is a “no-brainer.” Although they pay lower rental expenses than in California’s most expensive cities, they still exceed the national average and other nearby cities like San Luis Obispo, where Gen Z is expected to spend $197,000 on rent by age 30.

But luckily for Gen Z, their age group’s higher average income means they are narrowing the gap between renting and homeownership. In Santa Barbara, millennials would spend an additional $91,000 as homeowners compared to renters, while Gen Z homeowners would be paying $64,000 more than renters.

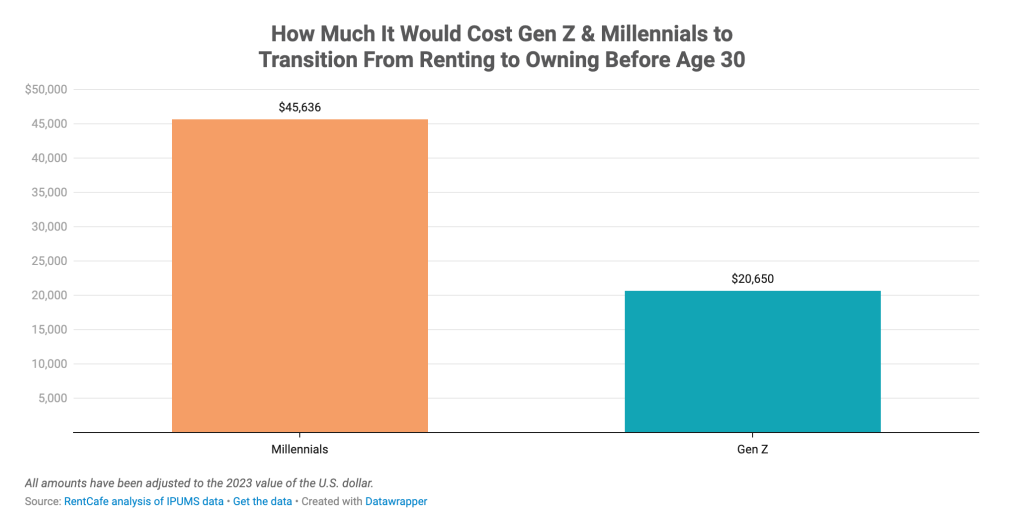

This trend is consistent across cities in the U.S. On average, millennials would need an additional $46,000 to transition from renting to owning by age 30, while Gen Z would require only $20,000. The portion of income spent on owning costs is even higher in popular metropolitan cities that are career and lifestyle hubs like Los Angeles, San Francisco, Honolulu, New York, and Boston. For Los Angeles, for example, homeownership consumes nearly half of both Gen Z and millennials’ incomes (47.3 percent for Gen Z and 49.9 percent for millennials).

So although homeownership is not as easy as it may have been for their parents and grandparents, data shows there is hope for Gen Z to close the gap for owning a home in future generations.

You must be logged in to post a comment.