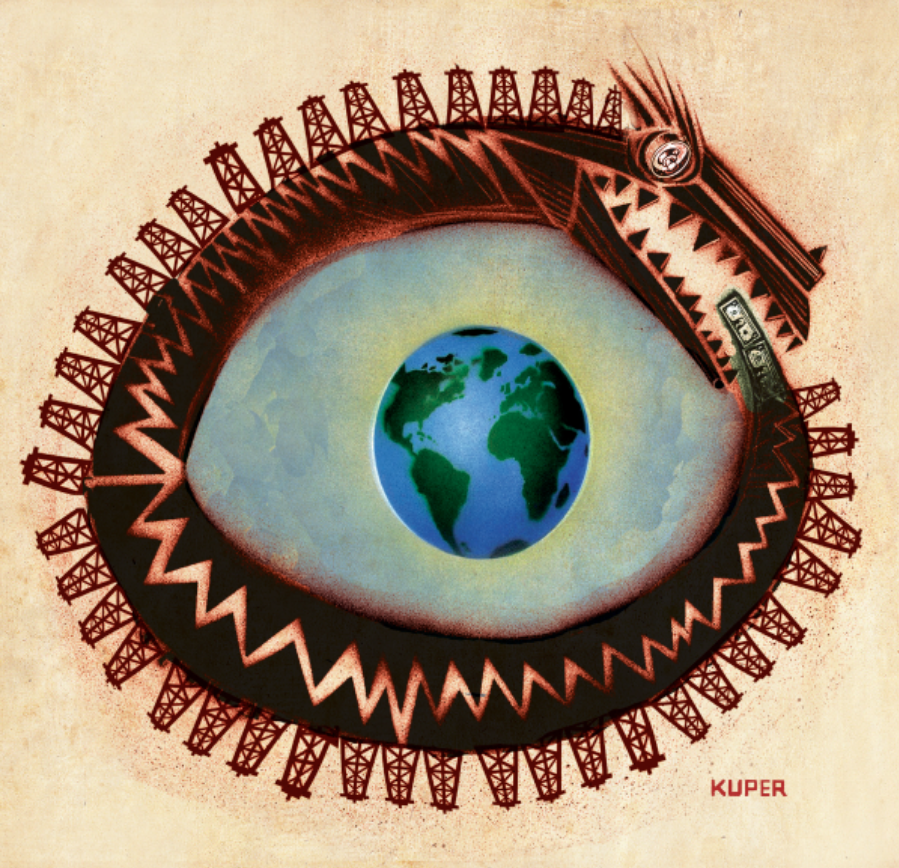

Climate Legislation that Could Save the Planet!

The Energy Innovation and Carbon Dividend Act Will Spur a Clean Energy Future

Climate legislation that would make coal, oil, and gas companies pay for their carbon pollution, use the revenue to support American households, and incentivize all nations, including China, to adopt similar policies was introduced into Congress in September by our Congressmember, Salud Carbajal. This legislation, he claims, will spur the transition from fossil fuels to a clean energy future while protecting vulnerable American households, adding thousands of clean energy jobs, and growing the economy.

Central Coast residents understand the need for climate legislation. We have seen firsthand how climate change exacerbates drought conditions and creates more frequent and intense wildfires. We’ve experienced “atmospheric rivers” of rain resulting in deadly debris flows because a warmer atmosphere holds more water. These are the costs incurred when we choose to power our economy with heat-trapping fossil fuels. The proposed legislation, HR-5744, the Energy Innovation and Carbon Dividend Act (EICDA), Carbajal contends, would reduce emissions 50 percent by 2030 and reach 100 percent reduction of net emissions by 2050.

It sounds great, but how can we know? Where’s the proof? How can we evaluate whether this market-based approach would be effective? Will fossil fuel companies really reduce production or simply pass on the carbon fee to their customers through increased prices? Will households use their cash rebates to choose clean energy options? Will China and other nations be motivated to adopt similar policies? Let’s consider who’s advocating this approach and whether they are respected and responsible sources we can trust.

The Intergovernmental Panel on Climate Change, which is composed of the world’s most prestigious climate scientists, declared in their Sixth Assessment Report (2022): “For a transition from dirty technologies to clean ones, market-based instruments such as carbon taxes should be considered alongside subsidies and other incentives that stimulate innovation … [carbon pricing can help] drive innovation and systemic carbon efficiency.” Further, citing a 2019 International Monetary Fund report, they argue that …“of the various mitigation strategies to reduce fossil fuel CO2 emissions, carbon taxes are the most powerful and efficient, because they allow firms and households to find the lowest-cost ways of reducing energy use and shifting toward cleaner alternatives.”

The U.S. Conference of Mayors, representing more than 1,400 cities, adopted a resolution in support of a national price on carbon emissions. “A national price on carbon emissions is the number one thing that Congress can do to begin to mitigate the impacts of climate change. If done right, a price on carbon will not only help clean the environment, but it will also create jobs all around America,” said Salt Lake City Mayor Jackie Biskupski.

Seventy major national health organizations, including the American Medical Association, have petitioned Congress to: “Put a price on carbon that reflects its true social costs and phase out investments and subsidies for fossil fuels for energy extraction and generation.”

Major faith denominations, evangelicals, even Pope Francis have endorsed a carbon fee and dividend approach to climate legislation, especially because these policies provide economic justice benefits for low- and middle-income families.

At both ends of the political spectrum there is support for carbon pricing. On the left, while the Green New Deal doesn’t explicitly mention a carbon tax, it’s best known champion, Alexandria Ocasio-Cortez (D-NY) has indicated she supports the polluter-pays principle by calling for “structuring an economy that is sustainable, where the externalities of the damage of some industries or markets get internalized.” In the last Congress (2021-22), 95 Democratic members signed on to co-sponsor HR-2307, a previous version of Carbajal’s proposed bill. On the right, Republican former secretaries of state James Baker and George Shultz, along with other GOP elder statesmen, formed the Climate Leadership Council in 2017 specifically to promote legislation that includes a carbon fee, a cash-back dividend, and a border carbon tariff.

Congressmember Carbajal’s legislation can also be evaluated by looking at results in the 40 nations around the world that have already adopted some of these climate policies. It should be noted that this bill calls for a carbon fee — technically not a tax since the revenue does not go into government coffers but into a Trust to be rebated to American households. Most carbon pricing systems around the world utilize emission trading schemes also known as cap-and-trade. Fossil fuel companies have accepted this approach more readily, no doubt because it is a drawn-out procedure subject to politics and prone to manipulation. Emission trading scandals abound. Alternately, a carbon fee, collected directly from coal, oil, and gas companies at the well, mine, or port of entry, is far more transparent, covers the whole economy, and prevents cheating.

A recent global study found that countries with a carbon price have lower CO2 emissions than countries without a carbon price. Here are some specific examples of effective carbon pricing:

- The European Union Emissions Trading System (EU ETS) is the world’s largest carbon market. To date, it has helped bring down emissions from power and industry sectors to 37 percent below 2005 levels, and it is on target to achieve at least 55 percent emission reductions by 2030 (below 1990 levels).

- The Regional Greenhouse Gas Initiative (RGGI) is a carbon cap-and-trade program in the northeastern United States involving 12 states. Since its inception, emissions have reduced by more than 50 percent — twice as fast as the nation as a whole — and so far raised nearly $6 billion to invest in local communities.

- Sweden instituted a gradually increasing carbon tax in 1991. Since then, greenhouse gas emissions have been reduced by 33 percent while Sweden’s economy as measured by Gross Domestic Product has risen more than 92 percent.

In today’s political climate, counting on Congress to solve the climate crisis will seem naïve and hopeless to many. After all, the current House of Representatives is in chaos because the Republican Party, which holds a thin majority, either will not govern or perversely wants to demonstrate that government does not work. Adding to the difficulty, most Republican representatives are climate science deniers who don’t believe burning fossil fuels is the cause of the climate impacts we are experiencing. Further, the GOP’s climate plan sets no goals for reducing emissions and advocates increased use of fossil fuels.

On the other hand, we must remember that the previous Congress, in 2022, with an even thinner majority of Democrats — and with no Republican votes — was able to pass our nation’s most significant climate legislation yet, the Inflation Reduction Act (IRA). In less than a year the economic investments it has unleashed for clean energy development are creating thousands of jobs and expanding economies throughout blue and red states alike.

Policies like the IRA, which offer subsidies to encourage consumers and businesses to choose clean energy alternatives, can be effective but may not reduce fossil fuel use fast enough to avoid catastrophic climate impacts. Similarly, planting more trees, eating less meat, traveling less on planes, cutting down on home energy use, and other efforts to reduce our carbon footprints do not address the climate crisis at the scale and speed required. The policies contained in the Energy Innovation and Carbon Dividend Act are advocated by well-respected, trusted sources, and the evidence of their effectiveness is being demonstrated around the world.

We owe Congressmember Carbajal a big thanks for his leadership on climate along with our support as he works on our behalf to get this promising legislation enacted.