Keeping the doors of libraries open in the future may depend on the outcome of a vote among Santa Barbara County residents for a tax to provide a dedicated revenue stream. For the past four years, an ad hoc committee has been meeting to work out the best way to coordinate what’s become five separate library systems and to agree on a means to fund all the libraries consistently — in cities and in the county.

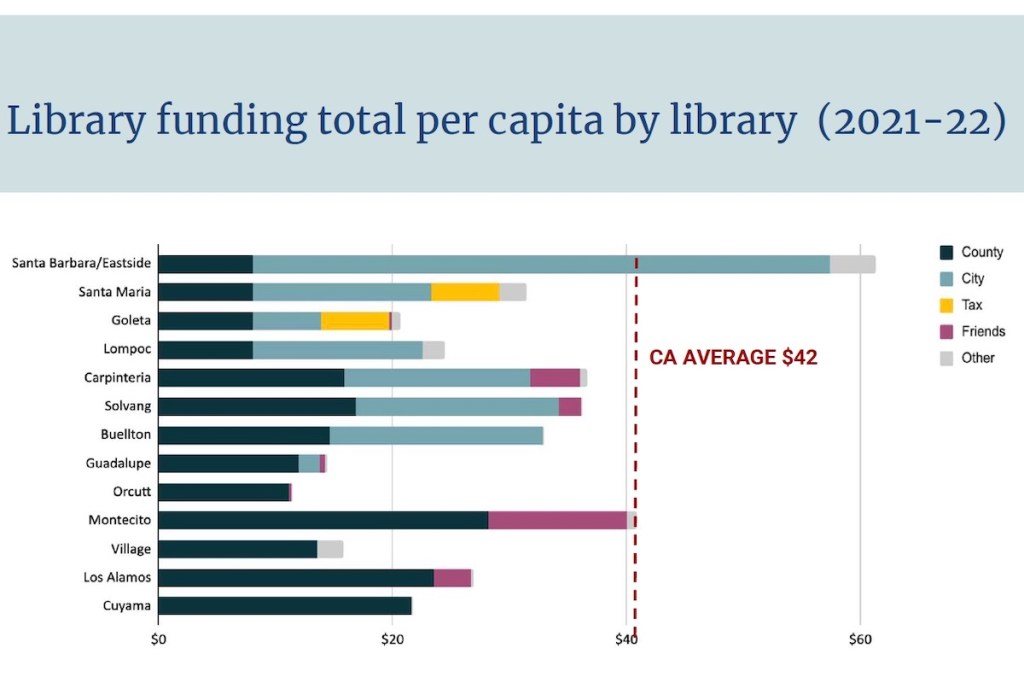

Before 2010, the State of California had provided the bulk of library funding for two decades, but when that ended, the financial burden fell to cities and the county depending on the number of libraries, branches, and “twigs” in their borders. Library budgets have constantly fallen short, to the level that local libraries run on much fewer dollars than others in California: $42 per capita is the statewide average. Only Montecito and Santa Barbara/Eastside meet the average. The others range between about $17 for Orcutt to about $37 for Carpinteria. It’s created a shortage of staffing and of services, including reading for all ages, voting information, computer access, employment help, and other assistance the libraries have taken on as community centers.

To organize and run a new financial model, a Joint Powers Authority (JPA) to handle a new tax was suggested by consultants in 2018, a model several other counties had used successfully. The ad hoc committee meetings pinned down what could be an acceptable combination: a JPA for the tax structure, and the libraries would continue to administer their own zones.

What complicates the picture is whether county residents have the stomach for more taxes. Goleta and Santa Maria just passed sales taxes last November on a 50-plus-one percent basis, but a dedicated parcel tax for one goal — funding all the libraries — would require a two-thirds vote.

The ad hoc committee attempted to project what could be raised with a one-eighth percent sales tax, or 0.125 percent, or a $60 per parcel property tax. And they considered the two possibilities throughout the county or in the smaller unincorporated areas only. The outcome was between $1.2 million and $10.5 million. For comparison, the libraries as a whole were $710,000 short to meet minimum standards of service and staffing last budget cycle.

The next step would be to reach out to the cities to see if they would support such a vote, said Carrie Kappel of LegacyWorks, a consultant for the committee, and to conduct polling to determine voters’ levels of interest. As well, the bits of library funding already part of some property taxes and a priority in various sales taxes — in Goleta, Carpinteria, Santa Maria, and Guadalupe — would also have to be worked out.

Most of the county supervisors were interested in the ideas, except for 4th District Supervisor Bob Nelson. He said he supported libraries, but he thought polling voters just probed for appealing sweet spots and that the county actually paid $30 per capita if viewed as spending in the unincorporated areas alone. The ad hoc committee clearly has some miles to travel to achieve the buy-in the idea needs. Currently, if this were to go to a public vote on a new library tax, the timeline is 2024 or 2025.