As Californians rush to file their taxes amid the pandemic-induced financial crisis and subsequent promises of $1,200 stimulus checks, many — especially the lowest income workers — may not realize they are also eligible to receive up to an additional $8,000 through the California Earned Income Tax Credit (CalEITC) program.

The program, which put $3.7 million in the pockets of Santa Barbara County low-income workers last year, requires low-income workers to file their taxes. Many of them aren’t required to, thus putting them at risk of missing out on both the federal stimulus check and the CalEITC cash-back tax credit, which could be as large as $8,000 depending on their income.

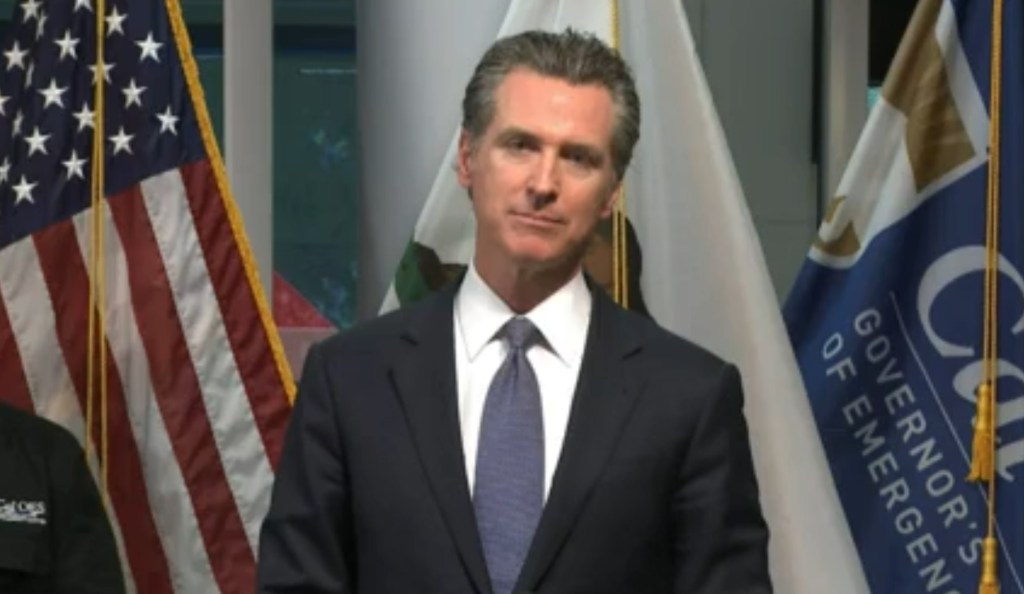

Last year the state set aside $400 million for CalEITC tax credits, $395 million of which was put back into the pockets of low-income California workers. Governor Gavin Newsom and the Legislature more than doubled that for 2020 and have $1 billion set aside. Golden State Opportunity, which runs the CalEITC program, is launching its “Million 4 a Billion” campaign on April 15 to reach one million Californians eligible to receive a slice of the $1 billion pie.

Getting the message out to the public has been successful since the program’s inception in 2016, but the stakes are even higher this year with pressure to reach workers who need cash in the face of COVID-19 layoffs, lost income, and overall financial insecurity.

“Our team is 100 percent committed to helping low-income Californians, many of whom were already struggling, to weather the grueling economic fallout from the COVID-19 pandemic,” said Amy Everitt, president of Golden State Opportunity.

“With access to stimulus checks and tax refund cash hinging on whether people file a return, we’ll be reaching one million low-income Californians to help them file their taxes so they can claim money that they’ve already earned and desperately need,” Everitt continued.

Morgan True, communications manager for Golden Opportunity, said that there were 19,864 Santa Barbarans who claimed a collective $3.7 million dollars from CalEITC last year. This year, he cited data from the Franchise Tax Board, which estimates 30,000 low-income earners in Santa Barbara County will receive $8.8 million from the $1 billion state-wide pot.

The campaign to reach low-income workers is launching April 15 because it is normally tax day, but due to the pandemic the deadline to file state taxes has been pushed back to July 15. In its mission to connect with one million eligible Californians during tax season, Golden State Opportunity will connect each person to free online tax filing resources with trained tax volunteer aides because the IRS is not currently able to process individual paper tax returns. The volunteer aides will also help workers sign up for other resources like unemployment benefits and CalFresh.

Last year, two million people claimed the credit state-wide. This year, an estimated seven million Californians and more than one million children could benefit from the CalEITC this year. To find out if you are one of them, check your eligibility requirements here.